Request For Payments

What is Request For Payments

Request For Payments is an exciting new service brought about by the Faster Payments Initiative of the FedNow ™ US Federal Reserve providing payments that are instant, final (irrevocable - "good funds") and secure.

Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions. Funds are available for use by the receiver and real-time confirmation is provided to both you ("the sender") and receiver in seconds. Most Good Funds transactions are "Credit Push" versus "Debit Pull."

Invoicing with Request for Payments (RfP) using ISO 20022 messaging standard can be integrated with various payment systems such as ACH (Automated Clearing House), FedNow, and other real-time payment networks. Here's how this integration might work:

- ISO 20022 Messaging Standard:

- ISO 20022 is a globally accepted standard for financial messaging, facilitating interoperability and standardization across different payment systems and institutions.

- Invoicing using ISO 20022 messaging ensures consistency and compatibility when exchanging payment-related information between different parties and systems.

- Request for Payments (RfP):

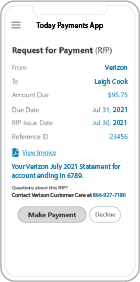

- RfP is a feature within ISO 20022 messaging that allows businesses to generate payment requests and send them to their customers or counterparties.

- When creating invoices, businesses can include RfP instructions, detailing the payment amount, due date, and instructions for initiating the payment.

- Integration with ACH:

- ACH is a widely used electronic funds transfer system in the United States, facilitating batch processing of credit and debit transactions.

- Businesses can integrate RfP invoices with ACH, allowing customers to initiate payments directly from their bank accounts using ACH transfer instructions provided in the invoice.

- Integration with FedNow:

- FedNow is a real-time gross settlement service developed by the Federal Reserve in the United States, enabling instant payments.

- Businesses can integrate RfP invoices with FedNow, allowing customers to make instant payments in real-time using the FedNow network.

- Integration with Real-Time Payments Networks:

- Besides ACH and FedNow, businesses can integrate RfP invoices with other real-time payments networks that support the ISO 20022 messaging standard.

- These networks may include third-party real-time payment systems operated by financial institutions or fintech companies.

- Payment Initiation and Confirmation:

- Customers receive RfP invoices containing payment instructions and can initiate payments using their preferred payment method, whether it's ACH, FedNow, or another real-time payment network.

- Upon payment initiation, businesses receive real-time notifications confirming payment receipt, allowing them to reconcile invoices and update their records accordingly.

- Enhanced Efficiency and Transparency:

- Integration of RfP with ISO 20022 messaging and various payment systems streamlines the invoicing and payment process, enhancing efficiency for businesses and providing transparency for customers.

- Real-time notifications and instant payment settlement improve cash flow management and reduce the risk of late payments.

By leveraging ISO 20022 messaging and integrating RfP with ACH, FedNow, and other real-time payments networks, businesses can create a seamless invoicing and payment experience, facilitating faster payment processing and enhancing customer satisfaction.

Request for payments (RfP) is a service that allows payees to send electronic payment requests to payers, simplifying the payment process. The factors influencing the adoption and effectiveness of RfP can be classified into three main categories: functional, emotional, and social.

1. Functional Factors

These factors are related to the practical and operational benefits of request for payments.

- Efficiency and Speed: RfP simplifies and accelerates the payment process by providing a direct and immediate way to request payments.

- Automation: Integration with accounting and invoicing systems can automate payment requests and tracking, reducing manual effort.

- Cost Reduction: By streamlining payment processes, RfP can reduce administrative costs and errors associated with traditional invoicing.

- Improved Cash Flow: Faster and more predictable payments help businesses manage their cash flow more effectively.

- Security and Accuracy: Enhanced security features and accurate data transfer minimize the risk of fraud and errors.

- Transparency and Tracking: Real-time tracking and notifications improve transparency for both payers and payees, providing clarity on payment status.

2. Emotional Factors

These factors pertain to the psychological benefits and user experience of request for payments.

- Convenience: The ability to send and receive payment requests electronically offers significant convenience over traditional methods.

- Trust and Reliability: Knowing that RfP systems are secure and reliable builds trust between payers and payees.

- Peace of Mind: Immediate confirmation of payment requests and receipts provides a sense of security and control.

- Satisfaction and Confidence: A smooth and efficient payment request process enhances user satisfaction and confidence in the system.

- Reduced Stress: Simplifying the payment process can reduce the stress associated with managing receivables and payables.

3. Social Factors

These factors involve the societal and cultural impacts of request for payments, including how RfP influences social interactions and behaviors.

- Adoption and Acceptance: As more businesses and individuals adopt RfP, it becomes a socially accepted norm, encouraging further adoption.

- Peer Influence: Users are likely to adopt RfP if they see their peers benefiting from the system.

- Financial Inclusion: RfP can promote financial inclusion by making it easier for underbanked populations to participate in electronic payments.

- Cultural Shift towards Digitalization: The increasing preference for digital solutions over traditional paper-based methods reflects a broader cultural shift towards digitalization.

- Community Impact: RfP can facilitate local commerce and peer-to-peer transactions, supporting community-level economic activities.

- Business Relationships: Improved payment processes can enhance business relationships by reducing payment-related disputes and fostering trust.

By understanding these factors, businesses and financial institutions can design and implement request for payments systems that meet the diverse needs of users, driving higher adoption and satisfaction rates.

About Request For Payments

RfP FedNow Request For Payment is a real-time payment system in the US that enables users to send and receive instant payments. While RfP FedNow Request For Payment is primarily designed for one-time payments, some banks and financial institutions may offer recurring invoicing options for businesses.

If your bank or financial institution offers a recurring invoicing option with RfP FedNow Request For Payment, you can use it to generate recurring bills for your customers. Here are the general steps for setting up recurring invoicing with RfP FedNow Request For Payment:

Enroll in the RfP FedNow Request For Payment service with your bank or financial institution, and inquire about the recurring invoicing option. You may need to provide information about your business and agree to specific terms and conditions.

Once enrolled, set up your recurring invoicing preferences in your bank's or financial institution's RfP FedNow Request For Payment system. This may include specifying the frequency of the recurring invoice, the payment amount, and the due date.

Create your initial invoice using your bank's or financial institution's RfP FedNow Request For Payment system. Include all relevant details such as the payment amount, the due date, and the recurring frequency.

Your bank's or financial institution's RfP FedNow Request For Payment system will automatically generate and send the recurring invoices based on your preferences.

Your customers will receive notifications about the recurring invoices and can make payments using their own RfP FedNow Request For Payment accounts.

You will receive instant notification and receive the payments in your account via RfP FedNow Request For Payment.

It's important to note that the specific steps for setting up recurring invoicing with RfP FedNow Request For Payment may vary depending on your bank or financial institution. Be sure to check with them for any specific instructions or requirements.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $500,000.

Money Transfer: Current limit of $500,000.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

Software Integration: Integrate your Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

Today Payments

...continues to meet the challenge of our clients by offering cost effective "good funds", real-time, instant, credit card, ACH and e-invoice payment processing services into the electronic payment solutions banking system. Electronic banking includes the transfer of funds between companies (B2B) and/or (B2C) consumer accounts for collection and payments. Today Payments Gateway Merchant Services gives your company choices in the method of faster payments that you can accept from your customers.

Our payment processing platform is designed for simplicity and ease-of-use.

SecureQB Cloud payment processing integration for QuickBooks ® give you the Best transaction detail information, real-time, with matching error-proof through QuickBooks.

Process with the Request For Payments Professionals

- Automation of Accounts Receivable Collection with Real-Time Settlement & Deposit

- Automation of Accounts Payable Payments with Real-Time Settlement & Deposit

- One-Time & Recurring Real-Time Credits with Settlement & Deposit

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payments payment processing